We’ve teamed up with the solar investing platform Energea to provide a way for you to offset your emissions by investing in solar projects around the world.

It’s a clean and simple integration that we think you’ll love.

In fact, this update realizes an orginial vision that I had for Decarbon way back in 2019. I’ve always believed that the app should help users automatically track carbon emissions and invest in emissions reducing projects (like solar).

“Invest” is the important keyword, because the idea is that offsetting your emissions doesn’t need to be an expense but instead can be something that has the potential to grow in value – just like investing in the stock market. That’s a big difference from buying conventional carbon credits.

Now, carbon offsetting can be touchy subject… so let’s dive into the details.

How does investing in renewable energy work?

Investing in solar energy supports a crucial shift from fossil fuels to renewable sources. Fossil fuel-based energy sources like coal-fired power plants contribute significantly to both climate change and ecosystem destruction.

When you choose to offset your footprint with Energea, you are buying stock in renewable energy portfolios that are managed by Energea.

Here’s how Energea works:

- Invest in different renewable energy project portfolios around the world (Community solar in Brazil, Solar in the USA, Solarize South Africa, etc.) for as little as $100

- Once the electricity from your support projects are generated and sold, cash flow is first used to maintain the project.

- The remaining revenue goes to shareholders like you! Energea disburses dividends on a monthly basis.

- Energea estimates the amount of carbon emissions avoided with the solar energy generated from your investments.

For more info, check out Energea’s FAQ.

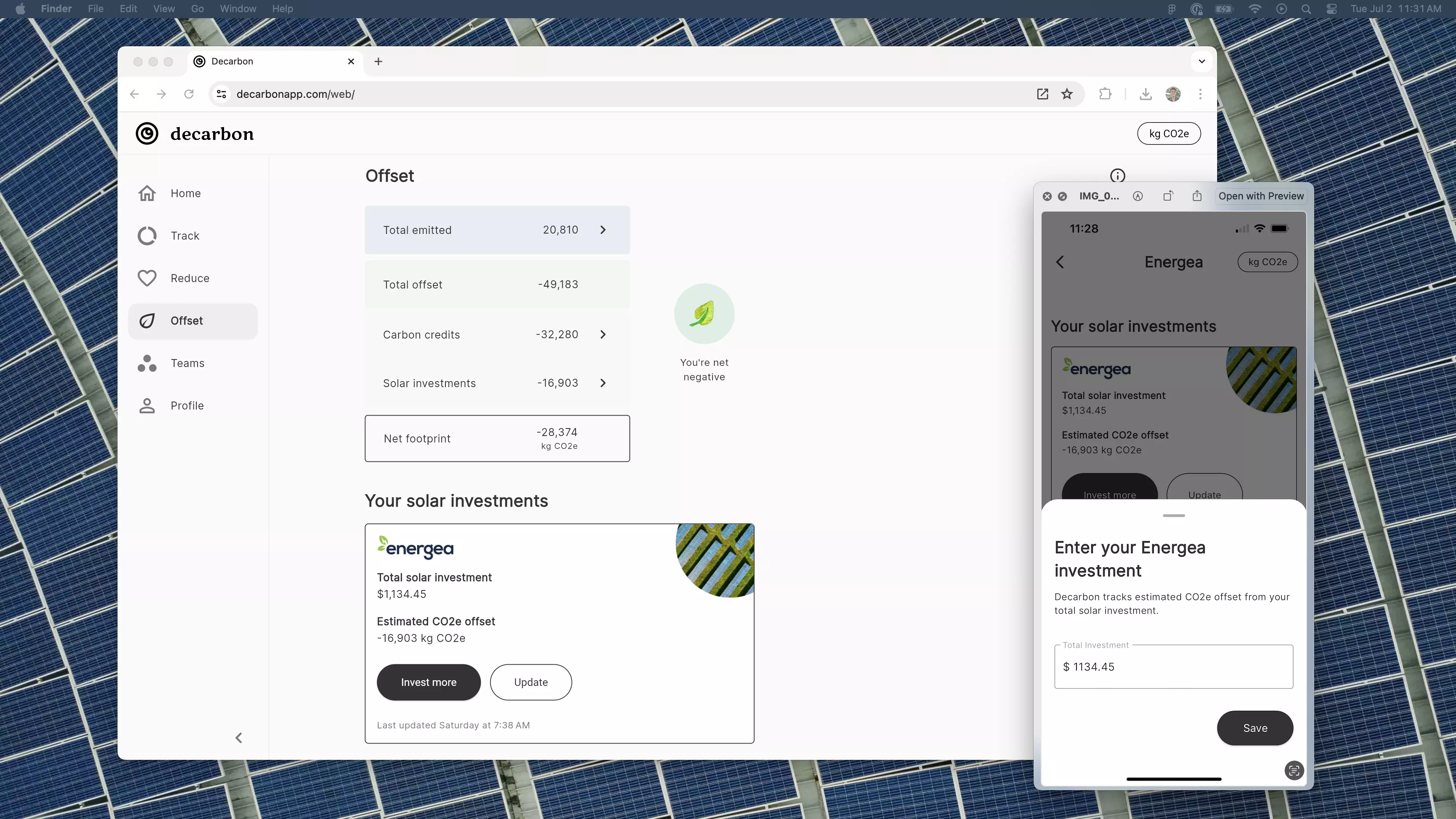

On the Decarbon side, we built a straightforward way to integrate your solar investments into your carbon emissions calculations.

Our intern, Molly, created a demo of how this looks in the app!

How it works on Decarbon:

- Open the Decarbon app

- Go to the Offsets screen

- Choose “Invest in solar projects”. New users can click “invest and get $50” to create an Energea account.

- Update your total amount invested to see the estimated emissions offset and how this helps your Net Footprint.

By using Decarbon’s referral link to get started with Energea, you’ll get $50 in bonus stock in the Community Solar in Brazil portfolio. Decarbon receives a small referral bonus too, so this is a great way to support our mission in the process!

Investing in renewable energy vs. buying carbon credits

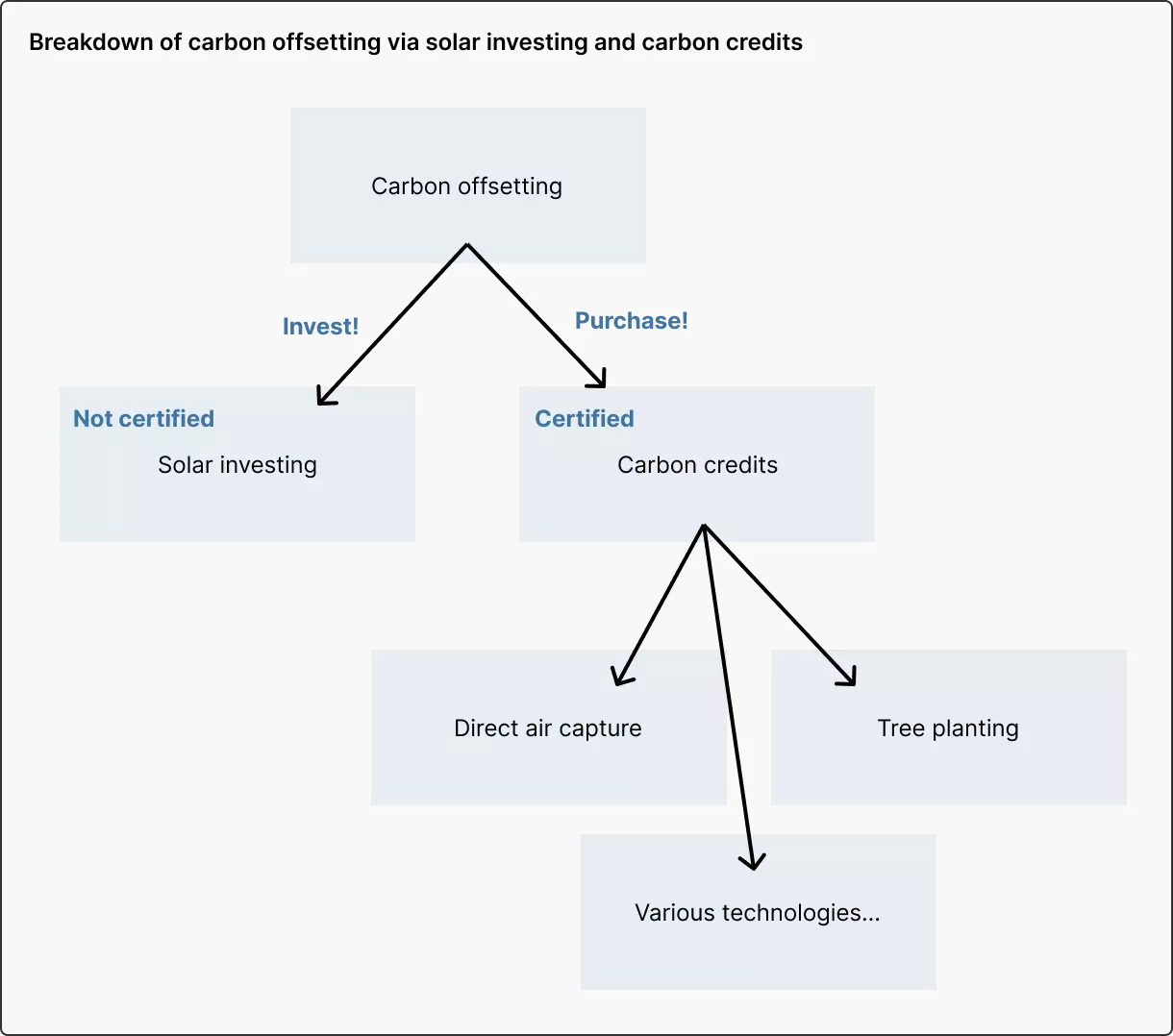

There’s two big differences between investing in solar projects and purchasing carbon credits.

Investing in solar projects directly with Energea generates passive income to you in the form of monthly dividend payments. Each month, the solar projects produce electricity and generate revenue. After paying any related operating expenses, the proceeds are then distributed amongst the portfolio investors pro rata. You can withdraw your monthly dividends each month or choose to automatically reinvest them. Investments in Energea can work a lot like an ETF or mutual fund with the exception that these are private investments and not publicly traded. Liquidity can be limited. Check out Energea’s FAQ to learn more about the liquidity of these investments.

Carbon credits are a purchase. So once you buy them, that’s it! They’re a straightforward expense.

The second big difference is that solar investing as a means of offsetting carbon emissions isn’t certified by a third party. The estimated emissions avoided that Energea provides to you are just that – estimates.

Carbon credits, on the other hand, are certified by different organizations like the American Carbon Registry, Gold Standard, etc. That means there are reporting requirements and analyses conducted to verify the amount of emissions offset. However, these certifications have been under intense scrunity over the last few years, with some scientists disputing the accuracy and efficacy of carbon credits.

At Decarbon, we believe that the estimates that Energrea provides around offsets via their investments are sufficient for individuals, as opposed to corporations who need to be rigorous about their carbon accounting. We’re highly confident that promoting the transition to clean energy benefits the environment, and, for individuals, we think it’s okay if the calculations aren’t 100% accurate as we strive to be as scientific, transparent, and realistic as possible.

What are the pros and cons of investing with Energea?

We obviously feel the pros of solar investing with Energrea vastly outweigh the cons, but here’s our perspective…

Pros

- Investing in renewable energy helps to create a more sustainable future

- $100 minimum investment – this is a low amount compared to other minimums out there

- Unique – There’s no other platform for anyone to directly invest in renewables in this way

- Receive monthly dividends from your investment

- Receive development and production updates on the projects you’ve invested in

- Energea is a great team of clean energy pioneers! They’re very accessible and helpful.

- Easily sync the amount offset with your net footprint on Decarbon

- Investing in Energea via Decarbon’s referral link supports Decarbon’s development

Cons

- Need to create an account and file 1099 tax documents

- $100 minimum investment – this is still a barrier to trying it out

- Complexity – investing with Energea is as complex as other forms of investing and you should be careful where you put your money. That said, if you do the research, you’ll get it!

- There’s some terms for how you can “cash out” or liquidate your investment

- The estimated avoided carbon emissions are not certified by a third party

Try it out!

And let us know what you think!